Better Homes Peterborough

Loan Program

The Better Homes Peterborough Program offers low-interest financing to help homeowners make energy efficient improvements. Your pathway to a comfortable, affordable and efficient home starts here.

Overview

The Better Homes Peterborough Program is designed to help homeowners reduce energy consumption and greenhouse gas emissions.

To qualify for loans and incentives, homes must achieve at least a 30% reduction in energy use or emissions.

Homeowners will receive personalized support throughout their program journey to ensure a smooth and successful process.

Better Homes Peterborough offers two funding opportunities:

Local Improvement Charge

Term

15 years

Interest Rate

4.50% (fixed)

Min. Loan Amount

$15,000

Max. Loan Amount

$50,000

Application Fee

$450

Financial Institute

Term

5 years

Interest Rate

5.20% (variable)

Max. Loan Amount

$50,000

Application Fee

$450

Eligibility

Requirements

Participation in the program is homeowner initiated.

The property is a residential building – detached, semi-detached, townhouse, or multi-unit buildings of 3 storeys or less

All property owners must agree to program enrollment

The property must have a property tax account with the City of Peterborough

Property taxes and all other payment obligations to the City of Peterborough must be in good standing

Application Process

Complete

an Application Form

The City of Peterborough will review your submission to determine program eligibility.

Access the Better Homes Peterborough Portal

After submitting your application form, you will receive instructions on how to access the Better Homes Peterborough Portal. Here you will be able to see the status of your application.

Book your Program Introduction Call

During this call, we’ll go over your goals, determine if you need any additional support or technical assistance, and address any questions you have about program eligibility or requirements.

Receive your Notice to Proceed

Once you have participated in the Program Introduction Call, you will receive your Notice to Proceed that will cover program and funding stream details.

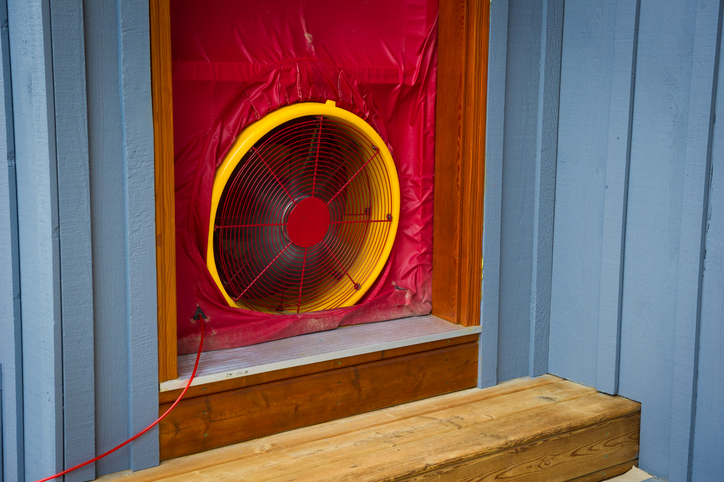

Book your Home Energy Assessment

Schedule your pre-retrofit home energy assessment if you have not completed one or upload your home energy assessment reports to the Better Homes Peterborough Portal.

Book your

Energy Coaching Session

The program’s Energy Coach will walk you through how your project can achieve the program’s energy savings target and help guide you through your retrofit journey.

Submit your Funding Request

Gather quotes from contractors for the projects you’d like to fund through the program.

Determine your funding stream

Decide whether you’d like to proceed through the Local Improvement Charge or the Financial Institute stream.

Book your follow-up Assessment

Once your improvements are complete, schedule a post-retrofit home energy assessment. The updated rating you receive will inform your project’s energy savings.

Submit your Project Completion Report

This involves sharing your final invoices and post-retrofit home energy assessment reports.

Repay your loan

Based on the funding stream selected, you can begin paying back your loan.

Ready to get started?

Apply now to take advantage of the Better Homes Peterborough Loan Program!

Program Incentives

Your energy savings can really pay off. If your home retrofit project significantly reduces energy use or greenhouse gas emissions, you could qualify for one of these performance-based incentives:

$1,000

for projects that achieve a 50% reduction in energy use or emissions

$2,000

for projects that achieve a 75% reduction in energy use or emissions

Savings must be verified through your home energy assessments, and the incentive will be applied as a discount on your loan balance.

Eligible

Measures

The following measures are eligible under the program, provided they meet applicable permits, regulations, and ENERGY STAR® certification requirements:

Building envelope

Attic, walls, foundation, and basement insulation and associated requirements such as:

- Attic ventilation, foundation drainage and waterproofing

- Air barriers, air sealing, and weather stripping

- ENERGY STAR® windows, skylights and exterior door replacements

Mechanical Systems

- Thermostats and controllers

- Energy or heat recovery ventilators

- Air source and ground source heat pumps

- High-efficiency water heaters (i.e., heat pump, electric water tanks, etc.)

- Drain water heat recovery systems

Renewable Energy

- Solar photovoltaic systems

- Battery storage devices

Smart & Other Technologies

- Permanently affixed lighting and lighting controls

- New energy efficient (certified) products

Other Eligible Measures

The following upgrades are subject to no more than 30 per cent of the total loan amount:

- Wiring and electrical service upgrades

- Electric vehicle charging stations (Level 2)

- Back-flow prevention valves

- Low-flow fixtures

- Cosmetics (roofing, foundation, interior walls (drywall, paint), asbestos removal)

- Energy audit and permit costs

FAQs

What rebate programs are currently available?

Check out the “Incentive Programs” page which highlights different rebate programs that are available for homeowners to take advantage of.

Does my home qualify?

To qualify:

- You must own a residential, detached, semi-detached, townhouse, or residential multi-unit building of 3 stories or less that is eligible for an EnerGuide assessment. To learn more about the ins and outs of an EnerGuide assessment, check out our blog post “What is a Home Energy Assessment?”

- The property must have a property tax account with the City of Peterborough

- Property tax, utility bills, and all other payment obligations to the City of Peterborough for the past five years must be in good standing. If it is not, the homeowner must submit a suitable credit check. If you are a new homeowner with less than 5 years of payment history, we will request a Credit Score. A minimum Credit Score of 600 will be required to receive program approval

- The property must not be in either CHMC’s Mortgage Deferral Program or the City’s Tax Deferral Program

Does the property need to be my primary residency?

No, landlords are encouraged to apply!

What measures are eligible?

Check out the “Eligible Upgrades” page which outlines the many eligible upgrade options available through Better Homes Peterborough.

If you don’t see the measure you have in mind on the list, contact betterhomesptbo@envirocentre.ca.

Please note that only costs incurred after you have signed your program agreement are eligible to be covered by the loan.

What happens if I do not complete all the work I planned?

Only the completed work and submitted receipts will be eligible for the loan value.

What is the minimum amount I will be eligible for?

Please note that the minimum loan amount which will be issued to an applicant through the LIC stream is $15,000. For a lower loan amount, you can inquire with Kawartha Credit Union (KCU) to participate in the Financial Institute stream.

Can I receive funding for upgrades completed before receiving program approval?

No. Any upgrades completed before signing your program agreement will not be eligible to receive funding. Eligible costs are those that are incurred after you have signed your program agreement, with the exception of an EnerGuide Assessment.

When should I start my retrofit work?

Only costs incurred after you have signed your program agreement are eligible to be covered by the loan.

Please wait to begin your project until you have received a countersigned copy of your Property Owner Agreement and submitted the Vendor Form for the City of Peterborough to process your initial disbursement (or have completed the Financial Institute stream loan agreement with KCU).

Can the costs of the EnerGuide assessment be covered under the loan?

Yes, the costs associated with obtaining an EnerGuide assessment, unless being covered through another program, are eligible under the Other Measures category.

Please keep in mind that the costs associated with the Pre-Retrofit EnerGuide assessment are likely to require payment in advance of receiving a program disbursement.

Can I apply for the Better Homes Peterborough Loan twice for the same property?

Yes, so long as your total loan amount between both applications does not exceed the $50,000 maximum loan amount.

Can I apply for multiple properties?

Yes, please apply for each property separately. Each property can be granted up to $50,000 in loans. You will have a portal login for each property separately.

Will Better Homes Peterborough cover upgrades that are non-energy efficiency measures?

Yes, other measures (non-energy efficiency measures) may be funded through Better Homes Peterborough and may make up no more than 30% of the cost of the eligible energy efficiency measures.

For example, if you are requesting $15,000 to put in a heat pump, you can request an additional $4500 for a non-energy upgrade such as a backwater valve, bringing your total loan amount to $19,500.

Check out the “Eligible Upgrades” page which outlines the many eligible upgrade options available through Better Homes Peterborough.

Do I need to obtain a Local Improvement Charge (LIC) loan?

Better Homes Peterborough offers two funding opportunities. You can obtain an LIC loan or an unsecured loan through Kawartha Credit Union.

What is the difference between the LIC stream and the financial institute stream?

Before you sign a loan agreement, you will be asked to choose a finance stream.

The Local Improvement Charge (LIC) stream levies the loan against a property through the municipal tax bill. The interest rate is fixed at 4.5% with a 15-year term for a minimum loan request of $15,000.

The financial institute stream is a partnership with Kawartha Credit Union (KCU) that offers a variable rate (to those who qualify), with a shorter term. This stream allows for loan requests below $15,000.

Both streams include an application fee of $450.

Both streams require the same application process, eligibility, and completion process. For the LIC stream, you will sign an agreement with the city of Peterborough. For the financial institute stream, you will visit a KCU branch and set up an account to get access to funding. Be sure to tell them you are participating in the Better Homes Peterborough program!

How long does it take for my initial application to be reviewed?

It will take approximately 10 business days to review your application. Once you submit your application form, the City of Peterborough will review the last 5 years of your property tax and utility accounts. When a decision is made on your application, you will receive an email from the program administration on how to proceed, or you can always check on the status of your application in the Better Homes Peterborough portal.

How long does it take for my funding request form submission to be reviewed?

Once you submit your Funding Request Form and related documentation, it will take approximately 1 week to approve your request and, if you choose the LIC stream, to send you your Property Owner Agreement. If documents are missing from your submission, our processing time may increase. You can review the Property Owner Agreement in advance here.

For the Financial Institute stream, KCU will outline their timelines with you.

How long does it take to receive my initial disbursement?

For the LIC stream, your Property Owner Agreement will have to be executed by the City of Peterborough before the City’s finance department begins processing your initial disbursement. The total processing time is 2 weeks before your initial disbursement is deposited into your account.

For the Financial Institute stream, KCU will outline their timelines with you.

How long does it take for my Project Completion Report submission to be reviewed?

Once you submit your Project Completion Report and related documentation, it will take us 1-2 weeks before we confirm your retrofit success!

If you are in the LIC stream, we will then send you your amended Property Owner Agreement and notify the City of Peterborough to begin processing your final disbursement. For the Financial Institute stream, KCU will be notified of your approval and begin processing your disbursement.

How long does it take to receive my final disbursement?

For the LIC stream, once everything is approved and documents are submitted for payment, it typically takes 10 business days for processing. Payments are issued on Fridays only.

For the Financial Institute stream, KCU will advise you of expected timelines.

How long do I have to complete all program steps?

Program applicants are encouraged to complete program participation within 1 year of receiving their Notice to Proceed.

What is a local improvement charge?

The repayment mechanism this program uses is called a Local Improvement Charge (LIC), which is a cost levied against a property by a municipality.

When do I receive the loan?

Applicants will receive the loan capital after they have submitted their final project documentation. When submitting your Funding Request Form you are able to request 50% of your estimated project cost in advance to help with deposits and other up-front costs. Please note that, depending on your project timeline, you may need to provide 25% deposits to contractors before you receive your initial disbursement.

What is the cost of borrowing and how is it calculated?

The cost of borrowing indicates the value of the interest that will be paid over the lifetime of the loan and is calculated based on the funding amount requested.

What is the interest rate on the loan?

Better Homes Peterborough offers a 15-year, 4.50% interest rate loan. This is a fixed-interest rate loan over 15 years.

If you request 50% of your estimated project cost in advance, daily interest (known as a Special Charge) will accrue. Upon receiving the final disbursement, interest will apply to the full loan amount until the bylaw date.

When does interest begin to accrue?

Interest will start to accrue on the initial 50% disbursement, if you choose to receive it. At that point, interest is only charged on the 50%. Once you receive the final disbursement, interest will begin to accrue on the full loan amount. You can see the total amounts on your Amortization Schedule.

Are there any application fees?

Yes, there is a $450 application fee that is added to yourloan repayment and paid back through the LIC over the loan period. No interest is applied on this application fee.

How do I repay my loan?

You will be able to continue paying your property tax bills, including the newly applied LIC, in the same way you’ve paid it historically. If you participate in the KCU stream, repayment for your loan will be captured in your agreement with Kawartha Credit Union.

Can I repay my loan early?

You can choose to pay off the remainder of your loan in one lump sum at any time without penalty.

What happens when I sell my property?

When you choose to sell, you can either opt to pay back the loan in full, or the loan will remain with the property and the new owner will continue to make payments on their property tax bill.

If you choose to retain the loan, be sure to disclose this to potential buyers.

How do I repay my loan?

You will need to repay your loan as agreed with Kawartha Credit Union.

Get Started

with the Better Homes Peterborough

Loan Program

Have questions about the program?

Call us at 1-888-284-9417 or

email us at betterhomesptbo@envirocentre.ca